ERP Accounting FAQs

ERP Accounting FAQs

What are ERP and Accounting?

Accounting systems focus on controlling financial activities whereas ERP has many functionalities including finance, sales, purchase, AR, AP, HR, Admin, and many more that centralize the business process and make decision-making faster for any company.

How is ERP Software used in Accounting?

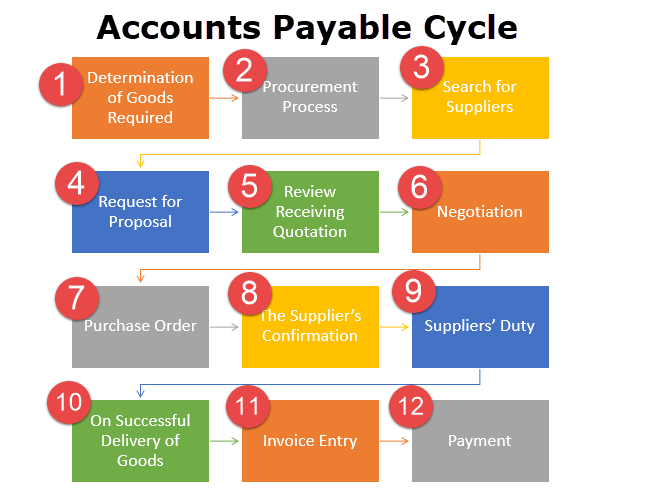

ERP software helps to automate the accounting process. ERP accounting system simplifies accounts payable operations, accounts receivable and improves cash flow problems with cash management. It becomes easier to manage the entire business process by generating and compiling company data.

What is ERP financial accounting?

ERP financial accounting is used for financial management. ERP Accounting Systems provides functions including profitability analysis and revenue management. ERP Accounting software is made to integrate business processes into a single software that runs on a central database.

What are Examples of ERP accounting?

Some of the popular examples of ERP accounting include Oracle, Ximple Solution, and SAP. Ximple Solution is specially designed for wholesale distribution accounting.

Do accountants use ERP systems?

Yes, accountants used the ERP system, Accounting ERP helps them by integrating data and streamlining all of their accounting processes. ERP also helps to speed up all accounting and financial management processes that save time and money with the ability to make faster and better decisions for your business.

What are the benefits of ERP in accounting?

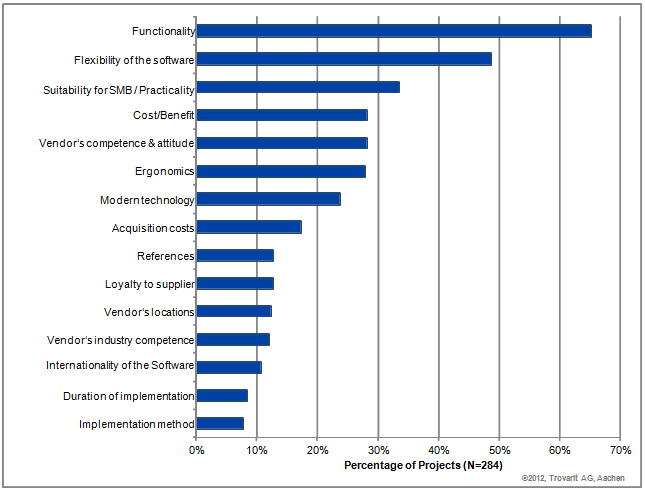

ERP and accounting software work separately, but ERP software provides valuable financial insights for businesses. Below are the main benefits of the ERP system for accounting for organizations.

- Automate and streamline data entry

- Better management of data

- Easy to access company data

- Enhanced customer relationships

- Customized accounting packages based on business

- Eenhanced cash flow process

- Customized accounting packages based on business

- Enhanced cash flow process, and better asset management

ERP Accounting FAQs

ERP Accounting FAQs